What is the SP500?

Created by YieldProject on 01 Apr 2024

Photo credit: Photo by Burak The Weekender

The SP500 is an index created by an American credit rating agency called Standard & Poor’s. The SP500 is designed to track the United States largest 500 publicly listed companies. Each company is weighted in the index by it’s market capitalisation size.

Index

A stock market index is a method used to track particular aspects of the stock market. The roots of the method date back to 1896 when we can see the first US index created called the DOW Jones Industrial Average. It was created as a way to track how the US economy was performing. This index still exists today but is no longer the standard go to for economy reference.

The drawback to the DOW jones is it was created solely using the share price as it’s weighting. So company A with a stock price of $100 and company B with a stock price of $200 will see company B taking up two-thirds of the index. On the surface this appears ok, but if anyone has been learning how the stock market works will know that the price of a share is not an accurate representation of company performance or total market capitalisation.

The SP500 creation was circa 1957 and would resolve the problems and create a new economic benchmark. Instead of purely using stock price a company’s weighting would instead be ascertained by the company’s total size or market capitalisation. This created a more accurate representation of the total US economy.

Investing

Why is the SP500 an issue? Well it isn’t for an investor as it is almost the birth right for becoming a staple in the financial independence movement. Back in the 1970s A famous fund manager tried to convince the American population that the SP500 index is the only investment you will need and will outperform most if not all fund managers over a long term period. He was often discredited as it was a major disruption for the managed services sector. But the figures didn’t lie.

Most index fund investing is now done through Exchange Traded Funds and Passive Managed Funds on platforms such as Vanguard and Blackrock. The accessibility for exchange traded funds no doubt has contributed to this large in flow. Index funds are cheap and perform well, you can access the SP500 on the ASX through the ticker IVV provided by iShares by Blackrock.

To this day index fund investing is now becoming so popular it is creating it’s own problems now encompassing almost a third of all SP500 investment nearing $7 Trillion. The problem now is the index providers control a lot of the market in a lot of the companies, the issues are still yet to be seen. www.cnbc.com, Feb 23.

Performance

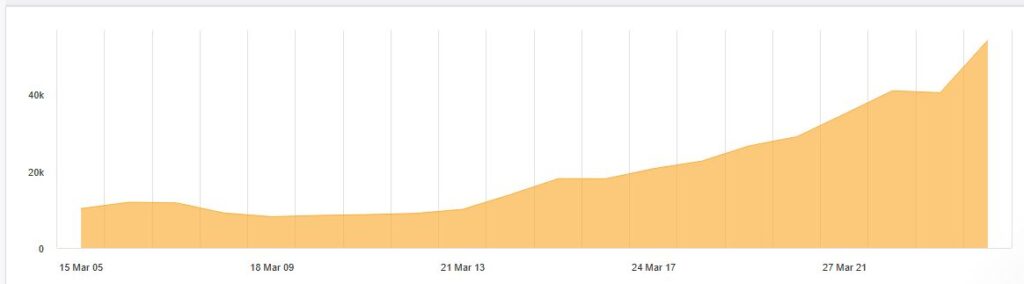

Chart Source : www.msn.com SP500 Performance

The performance of the SP500 is staggering especially when you know it is indeed the average performance of the economy. Whether it can maintain this trajectory is never known but many famous investors such as Warren Buffet and Charlie Munger will say not to bet against the US economy.

The SP500 has an annualised average return of 10% per year. But it is a wild 10% and rarely actually returns 10% more so van vary from -10% to +20%. Less common they can go from -50% to +50%. So the volatility is no question a reason people cannot sustain an SP500 investment. From the chart below you can see the volatility in returns, between the tech crash in 2000 and the GFC there was around 12 years of no market gains, it can be tough. But if you dollar cost averaged into the investment and held on you would have done well, easier said than done.

A $10,000 dollar investment made 20 years ago would be worth over $50000 not including re-investing dividends. If you would have dollar cost averaged during this period into the market you would have done extremely well.

Chart created using Sharesight

Fidelity performed an analysis and showed the best investors in the funds were in fact those who had passed away. The average index fund investor portfolio performance also undermines the actual SP500 performance by 30%. thebalance, 2021.

Underperformance is solely due to the fact of human nature, the perception that we any control of outcomes, the sense we have an ability to predict irrational events. The famous qoute “time in the market beats timing the market” is especially true when you look at the data.

Conclusion

See what’s inside our portfolio targeting a 7% yield

How much of every day life we have covered!

See our monthly income schedule!

All our monthly portfolio updates in one spot.

Light reading to help you along and see our top income stocks on our radar.