Washington H Soul Pattinson and Company

Written on 02 April 2024 by Yield Project

About

Washington H Soul Pattinson and Company is a company listed on the ASX with the ticker SOL. SOL is actually not a listed investment company when compared to the likes of Whitefield and Australian Foundation Investment Company. The reason being is SOL is more of a company that also hold a diverse range of assets. It is not intentionally created just to invest. There is a vast history that eventuated into SOL and is explained from their website itself Soul Patts — Soul Patts. We always like to see the history of many of the older companies as they always have a unique story.

“Soul Patts remains one of the few public companies that has been managed by the same family from the outset. Our story started when Caleb Soul and his son Washington opened their first store at 177 Pitt Street, Sydney, in 1872, while Lewy Pattinson opened his first pharmacy in Balmain in 1886. The men became friends.

Some years later Washington Soul approached his old friend, Lewy Pattinson, and asked if Pattinson & Co. would buy him out. Pattinson agreed and after discussion with his partners, Pattinson and Co. bought out Washington H. Soul and Co., effective from 1st April 1902.

Out of respect for his old friends, Lewy Pattinson included the name of Washington H. Soul in the name of the new Company, Washington H. Soul Pattinson and Company Limited, incorporated on 21 January, 1903 and listed on the Sydney Stock Exchange (now the Australian Securities Exchange). Today, we are affectionately known as Soul Patts and our Chairman, Robert Millner AO, Lewy’s great-grandson, represents the fourth generation of the family to Chair the Company.”

Holdings

Brickworks Limited

New Hope Group

TPG Telecom

Australia’s third largest telco with over 7 million customers. In an already saturated market TPG have done well to establish a significant foot print in Australia. Boasting a conglomerate of well known brands such as Vodafone, iiNet and AAPT it has been a great return of Washington H Soul Pattinson’s portfolio.

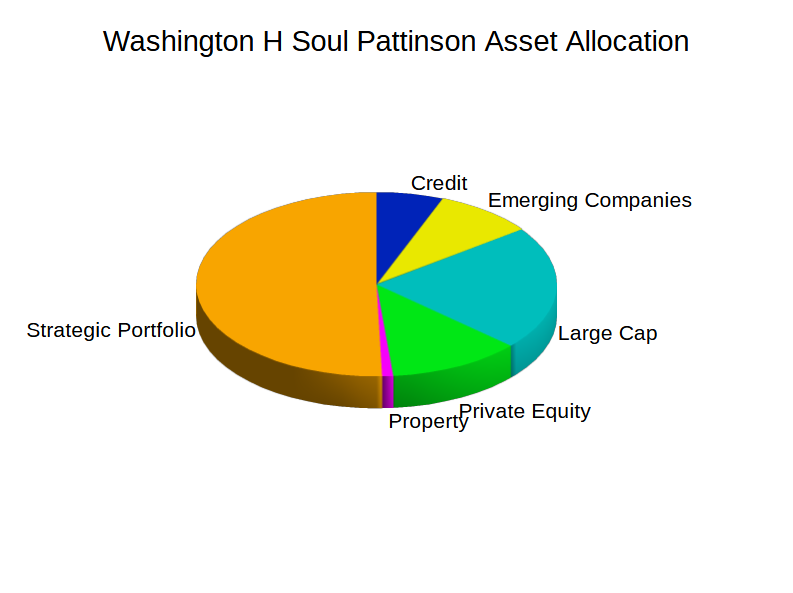

The rest of SOL’s portfolio comprises of a large cap approach focusing on quality dividend growth companies with a 22% holding of the total portfolio. Some of the smaller holdings include Private Equity 12%, Emerging Companies 9%, credit 6% and property 1%.

Performance

Over the last 20 year period the ASX accumulation index performed 9.0% annualised. In the same time SOL has performed 12.5%. To put this into real terms if you had invested $10 000 in the ASX index you would have over $55 000 today. The difference the 3.5% made is astounding, a $10 000 investment in SOL after compounding for 20 years you would almost have double the amount, $105 000!!!. It is not often to find a company that can continuously outperform the index. Of course with the benefit of hindsight it is also unlikely anyone would have 100% of their holdings in a single company, but it sure would have been a good part of your portfolio.

Long Term Outlook

Washington H Soul Patts and Company benefits from diversification. Although it can be argued it is less than ideal to have 3 holdings taking up 50% of the total assets they have also responsible for most of the profits. If we fast forward 10 to 15 years we would think TPG and New Hope will continue their great track record. With 7 million customers TPG sits in a great spot to increase market share against the likes of Optus and Telstra. New Hope mining group will continue to generate the key foundations for economic growth, coal, oil, gas and agriculture are the bed rock of Australian Industry. Even though the push for sustainable power generation is leading the charge it is extremely far off to be able to show impact, and that’s assuming New Hope won’t evolve with the current times which we are sure all companies will.

The rest of the portfolio is positioned to take advantage of Australia’s best profit producing companies such as BHP Group Limited, Macquarie Group Limited, Goodman Group Limited and Wesfarmers Limited. All of which are great quality companies.

Conclusion

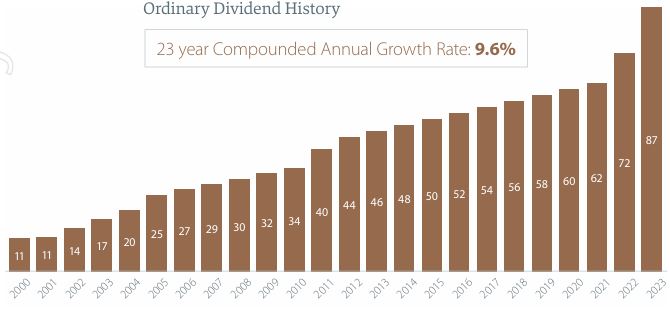

Holding SOL is a long term play as most investments should be. We will be adding more to our high dividend portfolio over the years as we expect continued profit and dividend growth over the next 10 to 15 years.

See what’s inside our portfolio targeting a 7% yield

How much of every day life we have covered!

See our monthly income schedule!

All our monthly portfolio updates in one spot.

Light reading to help you along and see our top income stocks on our radar.