Discover Your Own Unique Journey.

Financial Freedom

Financial Independance, Retire Early

Life Stability

March Update

Intro

March is a big update as it was the start of the portfolio and Yield Project. We ended up buying 5 companies boasting a high dividend. Some higher risk than others. High dividend portfolios you really need to check the underlying assets as the risk and reward profile may just not be what you are after.

Purchases

Our first purchase this month. MXT:ASX, Metrics Master Income Trust. Boasting a strong yield of approximately 8.5% we are rewarded with a nice monthly dividend. We should note that MXT sits quite high on our risk tolerance. When we talk about risk it is the chance to lose your money, to set the risk basis and also being a self proclaimed seasoned investor I would class Index Funds as low risk, why? Because if you lost all your money the world would be fighting for food instead of flaps of paper. Market ups and downs is called volatility and should expect and accept drawdown possibilities of 40% or more. So that leaves MXT as an actual possibility to lose money, investing in debt and private equity. What are the odds of losing your money, who knows but there’s a chance, still I am not too fussed.

Second purchase for the month is BHYB:ASX, Betashares Bank hybrids. A much less risky investment to MXT but nonetheless a nice monthly distribution of around 6.5%. Hybrids sit between a stock and a bond. The return of a stock without the complete safety of a bond. Not too bad for us, although for me I don’t really like bonds all that much.

Third buy for the month is QYLD. An ETF by GlobalX tracks the NASDAQ 100 index. Usually the NASDAQ has a low yield of between 1-3% however the strategy for QYLD is it’s ability to write covered call options. This creates an income. But don’ be fooled there is no free lunch this comes at the expense of limited upside potential as the income is derived from capital appreciation. So purely for income this is great, for a long term growth investment strategy it may not be suited for you.

Fourth purchase is JEPI, a fund created by a well known finance company JP Morgan. JEPI tracks the SP500 and similiar to QYLD write covered call options to create a boost to income. JEPI is a little different though as the options are written against a portion of the portfolio rather than the whole fund. This allows some upside growth while producing nice distributions.

Fifth purchase is VHY tracking Australia’s top dividend paying businesses. Provided by one of the worlds largest fund managers Vanguard. VHY has around 63 holdings and has a grossed up yield of around 6%. This ETF pays quarterly distributions with a solid track record.

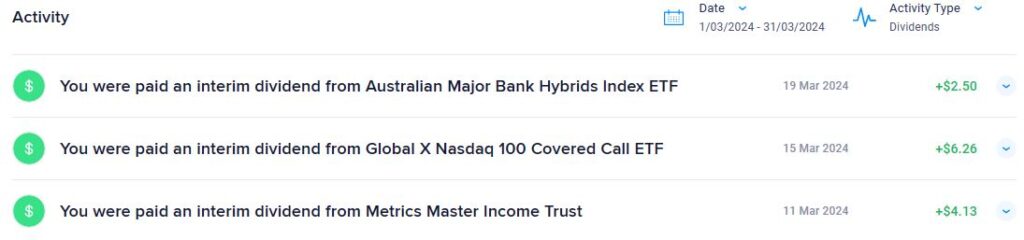

Income

Income for total of March stands at $12.50. Nothing to write home about however if you think about it that’s two takeaway coffees pre-purchased. So while it isn’t anything huge it is still productive in your day to day life.

Listening

Top podcast this month is the Choose FI podcast episode 411. I would say this is a must listen to learn about stock market investing to generate long term wealth. It is rather contradicting to what we are doing here at Project Yield focusing on income investing. However we believe strongly in the principles of long term broad based index fund investing. Our income portfolio will only take up 10% or less of our portfolio and is purely there to supplement our core index portfolio consisting of IVV, VGS and A200. So take a listen it is well worth it.

Reading

Currently reading the Power of Now by Eckhart Tolle. During your path to financial independence it is an important reminder not to live too much in the future. Planning for the future is a no brainer but do not forget that you should not be living in the future. Be present and be satisfied you are following your laid out plan.

Conclusion

See what’s inside our portfolio targeting a 7% yield

How much of every day life we have covered!

See our monthly income schedule!

All our monthly portfolio updates in one spot.

Light reading to help you along and see our top income stocks on our radar.