The Benefits of Income Investing

Written on 02 March 2024 by Yield Project

Long Term Investing

There is no doubt that the tried and tested index fund investing works. The whole characteristics of index investing allows the fund to self cleanse and reduce weighting of underperforming businesses and eventually removing them from the index. Businesses that do well are rewarded with a higher weighting within the fund so naturally the index will chase winners and remove losers over time. The other reason why it works is that the index tends to trend upwards as businesses increase wealth over time by increasing productivity and profits. In this day and age it is amplified more so by the printing of money or quantitative easing, money is created and over the long term will eventually be collected by those who know how, the top CEO’s of the world. So it is a no brainer to be a part of the capitalist world despite it’s flaws and have at least a portion of your total investment portfolio in broad based index funds. From the wealth you generate you can support and donate to the charities closest to you, and of course donate the most valuable asset in life, your time!

There is no doubt that the tried and tested index fund investing works. The whole characteristics of index investing allows the fund to self cleanse and reduce weighting of underperforming businesses and eventually removing them from the index. Businesses that do well are rewarded with a higher weighting within the fund so naturally the index will chase winners and remove losers over time. The other reason why it works is that the index tends to trend upwards as businesses increase wealth over time by increasing productivity and profits. In this day and age it is amplified more so by the printing of money or quantitative easing, money is created and over the long term will eventually be collected by those who know how, the top CEO’s of the world. So it is a no brainer to be a part of the capitalist world despite it’s flaws and have at least a portion of your total investment portfolio in broad based index funds. From the wealth you generate you can support and donate to the charities closest to you, and of course donate the most valuable asset in life, your time!

The Benefits of Income Investing

Correlation

Not proportionally correlated to market performance – Income investing may provide portfolio resilience during bear markets, this is due to the nature of investing in private equity and debt which can have fixed durations tied to it. Also high dividend stocks tend to be more stable players and are often blue chip companies which can continue profits during bear markets. During the covid era we could see consumer staples and the finance sector driving through the bear markets for example Woolworths, Coles, CBA, Wesfarmers.

Stability

During times of personal crisis a consistent income can smooth over any curve balls life can throw at you. Such as losing your job or unable to work for other various reasons, your income portfolio may not cover all expenses just yet but it may be able to carry you over till you land your next gig. The income will avoid you having to touch your emergency fund and most importantly your core index fund portfolio, as the saying goes “do not unnecessarily interrupt compounding interest”.

Opportunity Cost

It can be argued that having your funds in income producing assets is already an opportunity cost. However most people do not have enough rationality to do a 100% SP500 portfolio (and maybe 10% government bonds to provide a better risk adjusted return), even though this is what is recommended by the famous investor Warren Buffet. During bear markets people tend to either invest less during the period or even move to cash or other defensive assets. A passive income portfolio can provide you with funds during these times to invest during the bear markets allowing stock purchases on huge discounts.

Human Tendencies

The biggest player, psychology, everyone gets excited over dividends. It is inefficient, irrational and doesn’t beat a diversified Index fund portfolio. But, your best investment plan is the one you stick with, even if it means allocating parts of portfolio to income investing. If you see our portfolio updates you will see a stream of dividends continuously coming in, it is definitely enough to get us excited about investing.

Financial Independence

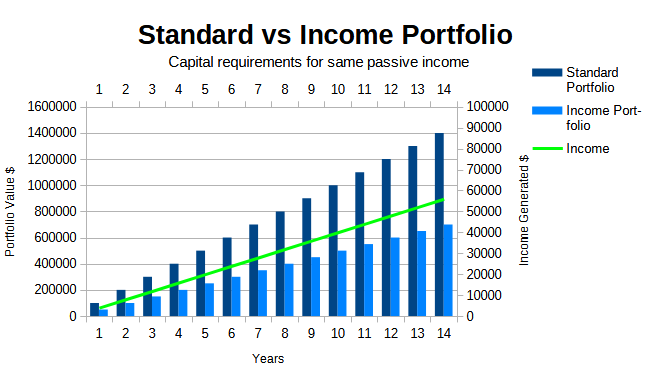

The Trinity study suggests you can safely withdraw down on your portfolio of 4% per year once you have reached your FI number of 25x your annual expenses. The idea is the portfolio will never run out and maintains an increasing balance and income that keeps up with inflation. For example annual expenses of $50k you would need $1.25m. But what if you could maintain an 8% income yield? This is not only achievable it is simple when you include franking credits using Australian LIC’s, Hybrids and private equity. You would only need half the amount invested $625K to reach your FI goal. The caveat here is the income and capital is unlikely to grow, but once your FI it is also unlikely that you will never earn another cent again through human labour. So speeding up your FI target can speed you up to work on the things that really interest you without the pressure of needing to cover basic expenses. It is essentially Freedom in half the time!

Sequence of Returns

The most efficient way to counter this is to hold several years of cash to wait out the downturns, it is very effective and safe. But, what if you had additional income during this time? Well you could invest further when the market is on a discount of 40% and take advantage of tough times. The income portfolio is likely to generate less during these times but it will surely be better than zero and should be better than the cash rate.

Visually

In the graph below we can visually see the drastic difference in portfolio size required to hit Financial Independence with an income focused portfolio. Of course you can achieve the same result by selling down your assets however during bear markets this is often easier said then done. So once reaching your FI number simply by converting some or all of your portfolio to income generation can lead you to FI much sooner than you may think. It may not be the best long term solution 10+ years due to lack of capital growth but it opens doors and gives opportunity to follow the work and passion projects you desire the most. We don’t often focus on the retire early part of FIRE as humans are designed to work, socialise and create. So most people will often continue working anyway, but as Financially Independent!

What to look out for?

- The Yield Trap – A high yield looks attractive. But lets look at what yield is, the yield of an asset is the distribution or dividend distributed in a percentage of the assets total capital represented by it’s share price. So for example if company A is worth $100

- Capital erosion – This is especially pertinent to trust products such as Exchange Traded Funds and Listed Investment Trusts due to the nature of requiring to distribute all income received. When funds buy and sell stocks any profit is required to be re-distributed instead of re-invested, a reason why some people prefer Listed Invested Companies.

- High risk -High return generally comes with high risk. Some assets in our portfolio such as QYLD are a high return product, we acknowledge what the product is and know it is volatile and likely to underperform it’s underlying index. Just know what you are buying and diversify.

Conclusion

See what’s inside our portfolio targeting a 7% yield

How much of every day life we have covered!

See our monthly income schedule!

All our monthly portfolio updates in one spot.

Light reading to help you along and see our top income stocks on our radar.