Discover Your Own Unique Journey.

Financial Freedom

Financial Independance, Retire Early

Life Stability

Created on 16 February 2024 by Yield Project FI

How To Start a Budget

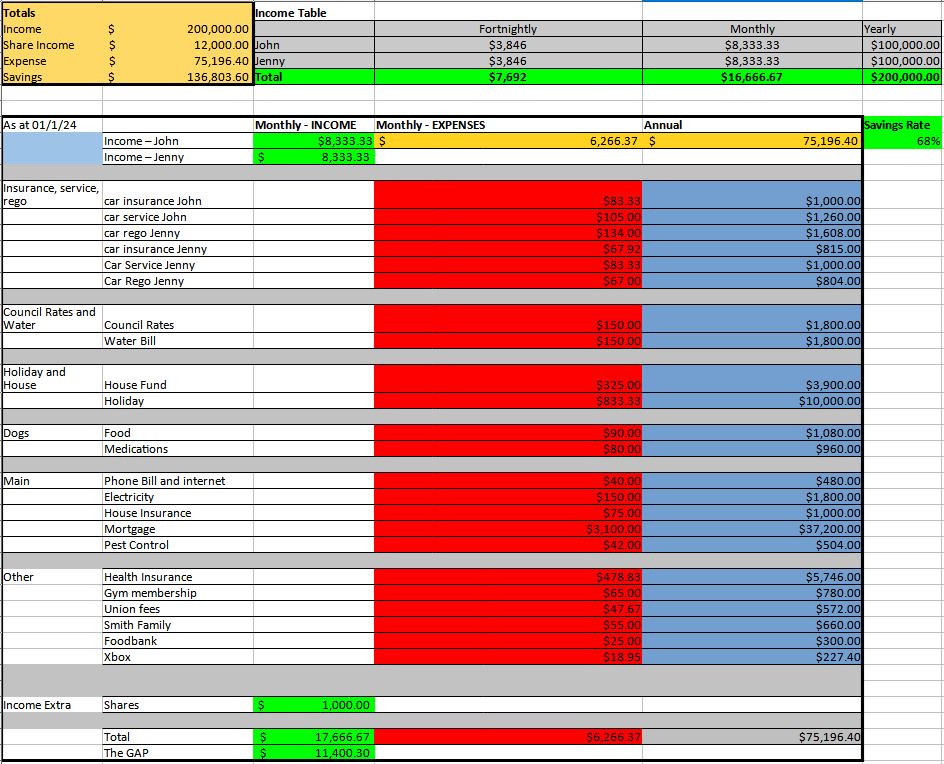

The daunting task of starting a budget is very off putting for many people, including us. It was an eye opener on what was happening to our finances. Even if you don’t want to follow a budget at the bare minimum at least track where your expenses are going, you may be unpleasantly surprised!

Introduction

Budgeting Terms

Pay Yourself First

Zero Based Budgeting

Envelope System

The envelope system was coined this phrase due to becoming popular well before the digital age. It meant that somewhere in your house were envelopes and each envelope would be labelled with a purpose. This could be groceries, other bills or just savings. It ties in extremely well with zero based budgeting as each week you would withdraw your cash and allocate amounts into each envelope according to your budget. In today’s digital age this is much simpler, there are several banks out there that facilitate this function extremely easy. For example our mortgage is offset with a savings account, within the account we can open several other up to 10 more, each of these add to offsetting the mortgage. Each account can be labelled and transactions automated to fill up the accounts for each determined expenditure. When it comes time to collect simply locate the envelope with the labelled expense.

Automation

Tieing the two together, zero based budgeting and the envelope system you will have a power house budgeting strategy and never be short of funds. To increase the effectiveness further you will want to automate the transactions. Using your bank you can schedule transactions as you receive your pay and to go a step further some employers allow you to split your pay into two bank accounts, this removes any psychological barriers and allows you to remove unnecessary thoughts from your mind.

The How To