April Update

Written 03 May 2024 by Yield Project

Intro

Purchases

PL8

For this month’s first purchase we bought Plato Income Maximiser Fund. Listed on the ASX with the ticket PL8 they boast a strong monthly income performance. Currently the dividend is 0.55c per share. Total performance is inline with the ASX 200 index at around 10.1% p.a. The dividends come fully franked with a trailing yield of 5.45% + franking credits. Since inception the income yield is around 7.6% p.a.

Something to keep in mind is even though the performance is similiar to the ASX index there is a little bit more tax being paid as this fund is income targeting. The management fee is high at 0.8%. The income has been trending upwards however there is a low period during Covid in 2020 where the income dropped which is expected. The fund data is only available to 2017 so not the widest data set to look at.

SOL

Income

Income for total of April stands at $43. From previous month that is around triple the return however that’s only because we don’t have too much invested just yet. At around the 50$ mark the income becomes significant. At $600 per year it is enough to pay at least 1 major bill. Or is enough to pay for take away for a month or 8 takeaway coffees. Current yield is at 6.9% not including franking credits. This is pretty much where we want to sit for our ideal yield target. We are already running a fairly high risk portfolio and don’t want to risk capital erosion so we won’t chase a much higher yield.

Other Investments

Core

Alternative

Listening

READING

Nothing to write about in this space. Extremely slow reader so still getting through the Power of Now. Highly recommend. It’s to work on what actually matters and stop thinking about the things that don’t. But going on a previously read book by Peter Thornhill he has a book called Motivated Money. Extremely good read, explains the power of LIC’s over the long term. In short after a decade or two of investing in the classis LIC’s such as Argo, AFIC and Whitefield you end up with a high yield of almost 10%. This is because over time the old school LIC’s increase their dividends and so after two decades the income you are receiving is now 50-100% higher for the cost basis of the share bought 20 years ago. A little hard to explain but definitely worth a read.

Conclusion

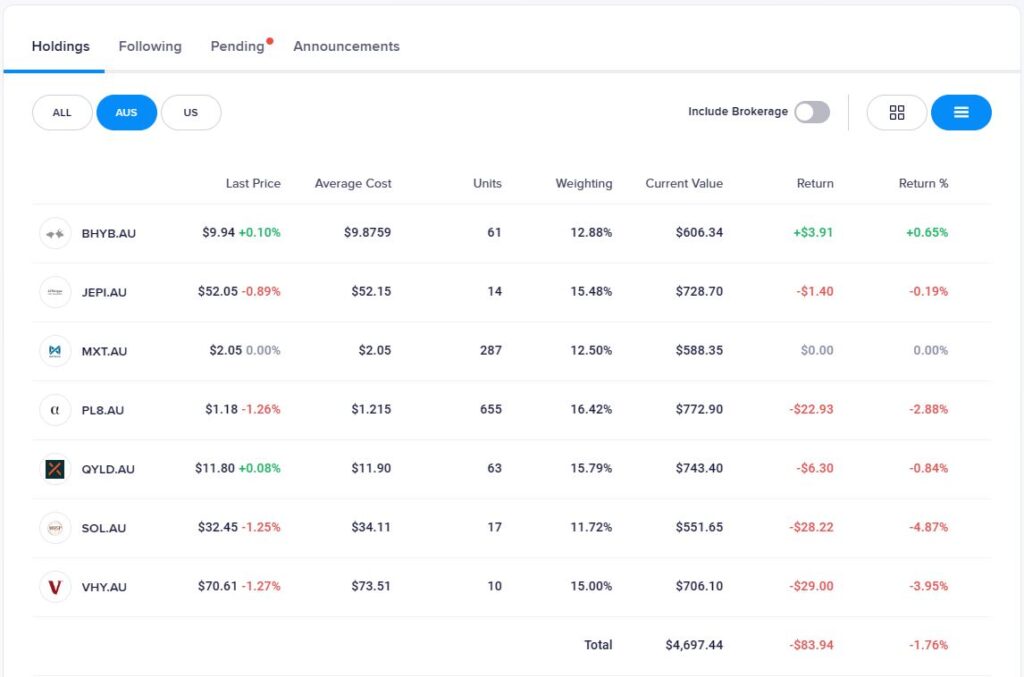

See what’s inside our portfolio targeting a 7% yield

How much of every day life we have covered!

See our monthly income schedule!

All our monthly portfolio updates in one spot.

Light reading to help you along and see our top income stocks on our radar.