Discover Your Own Unique Journey.

Financial Freedom

Financial Independance, Retire Early

Life Stability

JPMorgan Equity Premium Income Active ETF

About

We added the JPMorgan Equity Premium Income Active ETF JEPI to our portfolio. The inception year for the fund is May 2020 so a long term track record isn’t available however according to Morning Star Article The Most Successful ETF Launch of All Time Raises Questions it may just be the most popular ETF to launch to date, in it’s first three years it has acquired over $27 Billion in funds. This fund has a great track record giving us a yield of around 7% while the average bank savings deposit is yielding around 4.3%. JEPI is designed to track the SP500 index whilst creating covered call options to provide increased income. The fund only writes options on a portion of the total assets allowing the fund to provide some long term growth with a consistent income.

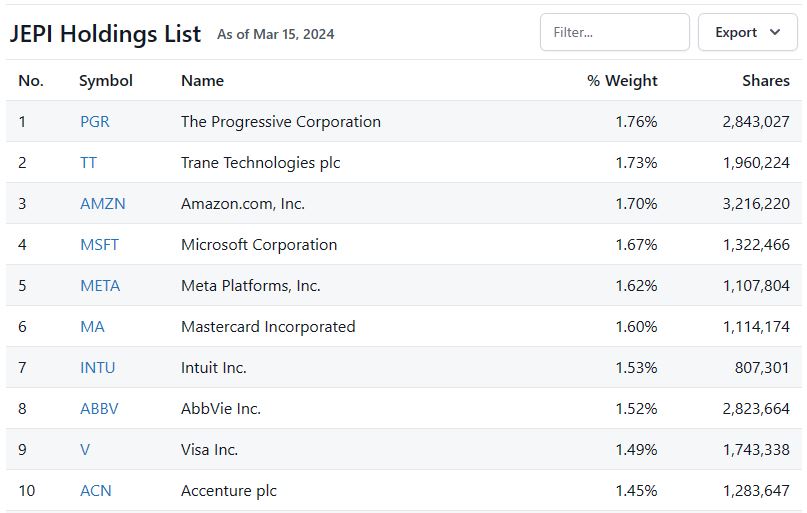

The top ten holdings comprise only 16% of the total funds under management compare that to the SP500 which has a weighting of 32%. This difference allows more diversity through holdings and less single company risk. This risk can be questioned when looking at the theory behind index funds but it is still worth considering.

Top Holdings

Image Source: JEPI Holdings List – JPMorgan Equity Premium Income ETF, Stock Analysis.com 19 March 2024

Need to KNow

This fund is expected not to out perform it’s underlying index. The risk in investing in this fund is largely opportunity cost. The nature of it’s structure means upside is mostly sold through covered calls to generate income. So if your strategy is long term efficient growth this may not be what you are after, however if you like us here at the YieldProject this is exactly what we are after, a large cap fund generating income. The management fee is much higher than it’s underlying index at 0.35%. However still less than other close competitor funds.

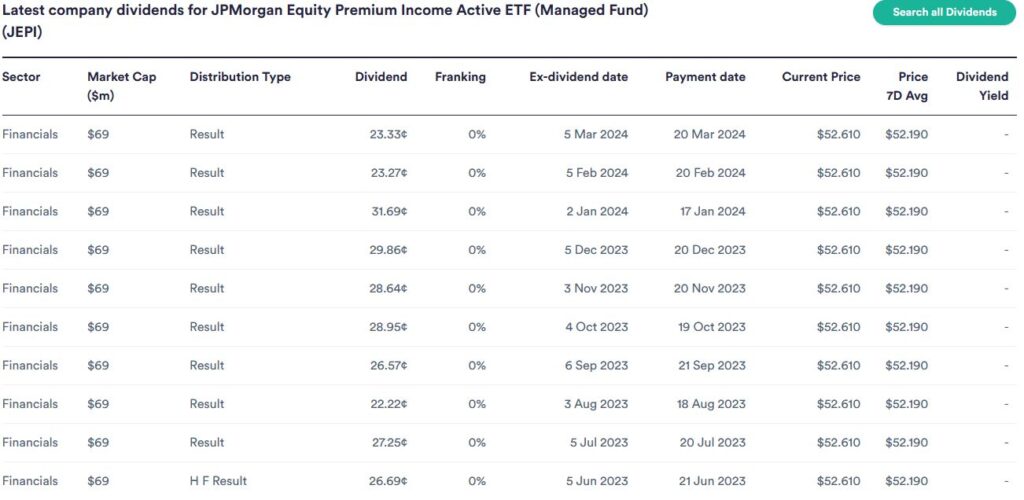

Distributions

Image Source: JPMorgan Equity Premium Income Active ETF (Managed Fund) (ASX: JEPI) – Dividends, www.investsmart.com,19 March 2020

Pros

- Monthly Income

- Relatively stable distributions

- Great track record

- Tracking large cap stocks, high liquidity

- Somewhat uncorrelated to stock market fluctuations, volatility becomes beneficial

Cons

- Fees are much higher than just buying the index 0.35% (equiv. 0.04% IVV by IShares)

- Unlikely to beat the underlying index