Betashares Australian Major Bank hybrids index etf BHYB

Written on 15 February 2024 by Yield Project

About

The Australian Major Bank Hybrids Index ETF ticker is BHYB and is found on the Australia stock exchange ASX. The fund purpose is to track the major big 4 banks and their issued hybrid products. Generally hybrids act fairly defensively as the big four banks in Australia are closely tied in to the housing market. You can expect the distribution yield to sit a couple of percentage points above inflation. The asset isn’t designed for growth but to maintain a consistent stream of income and carries less risk than just holding the stock. The management fee is 0.35% p.a.

Performance

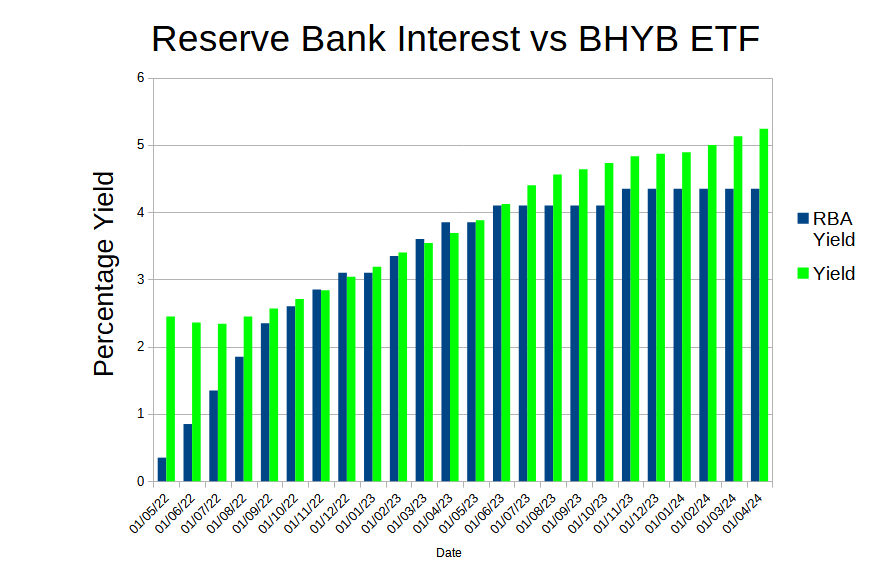

When comparing the performance of BHYB it is hard to compare it to any standard index since it is an entirely different product. So the best we can gauge performance is looking at the yield and capital preservation. Looking at the below chart showing RBA interest rate versus the Betashares Australian Major Banks Hybrids Index ETF is it clear that BHYB stays ahead of RBA. The chart only shows the last 2 years but it was probably one of the most interesting 2 years for the past decade. RBA interest rates went from near 0 all the way to 4.35%. The times of underperformance of BHYB is due to how quickly the rates were being raised, since bonds have a duration and mature date it creates a somewhat smoother progression to rate increases.

Yield

Unit Price

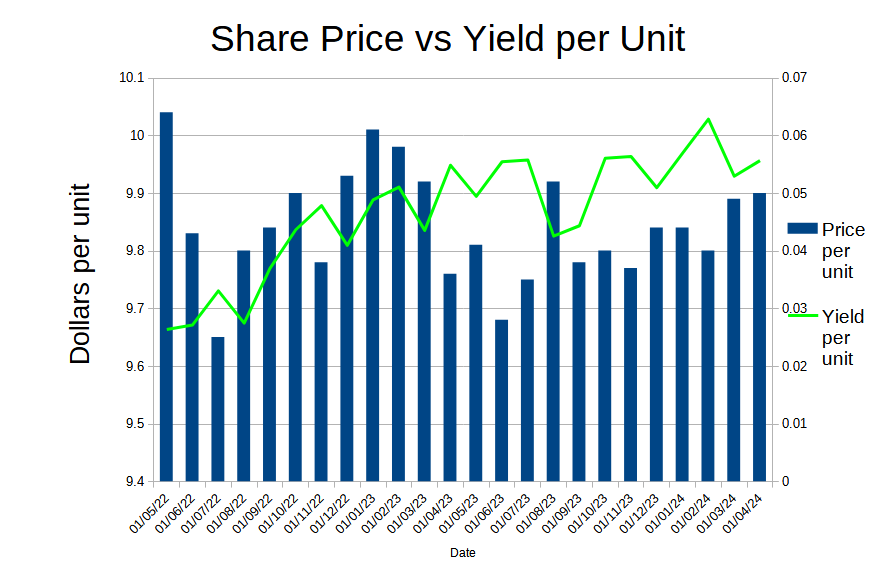

The yield is looking good for an asset to protect from inflation. However yield is of not much value if it is causing capital erosion. Capital erosion as the decrease in asset value over time. Often high yielding assets can come with a decreasing value, this happens because upwards growth is often sold off to and given back to the shareholder as a dividend. Upwards growth is capped. So to ensure the yield growth isn’t just capital erosion we need to have a look at the asset price and distribution per unit.

Looking at Chart 2: Share Price vs Yield per Unit below the price of the asset only fluctuates between $9.65 and $10.5 or less than 0.08% so safe to say the price point is relatively stable. Over the same period the distribution or yield paid per unit has been increasing. So another reason for an inflation hedge is we have a stable asset price with a stable yield. Caveat here is this is only 2 years of data as BHYB has not been around for too long, but if you want to you could back track this data for many years tracking individual hybrids. The data used includes any franking credits. Take a look at our article What are Franking Credits to see how they work. Data sourced from Betashares Australian Major Bank Hybrids INDEX ETF (ASX:BHYB) Share Price – Market Index.

Pros

- Monthly Income

- Relatively stable distributions

- Great track record

- Backed by real estate

- Somewhat uncorrelated to stock market fluctuations

- Generally the higher the RBA cash rate the higher return

Cons

- Bond like product generally produces total lower returns

- Not much diversification since it is tracking the big 4

Conclusion

The Betashares Australian Banks Hybrid Index is a great inflation hedge. You wouldn’t expect performance above the standard ASX 200 Index or long term capital growth but you also wouldn’t expect the same volatility. So if you are after a smoother ride and monthly income it may be worth taking a look at BHYB for your portfolio.

See what’s inside our portfolio targeting a 7% yield

How much of every day life we have covered!

See our monthly income schedule!

All our monthly portfolio updates in one spot.

Light reading to help you along and see our top income stocks on our radar.